Click to Enlarge

Read MoreOil and gas industry infographic regarding tax deductible investments related to the industry. When sharing, please attribute and link back to Aresco LP.

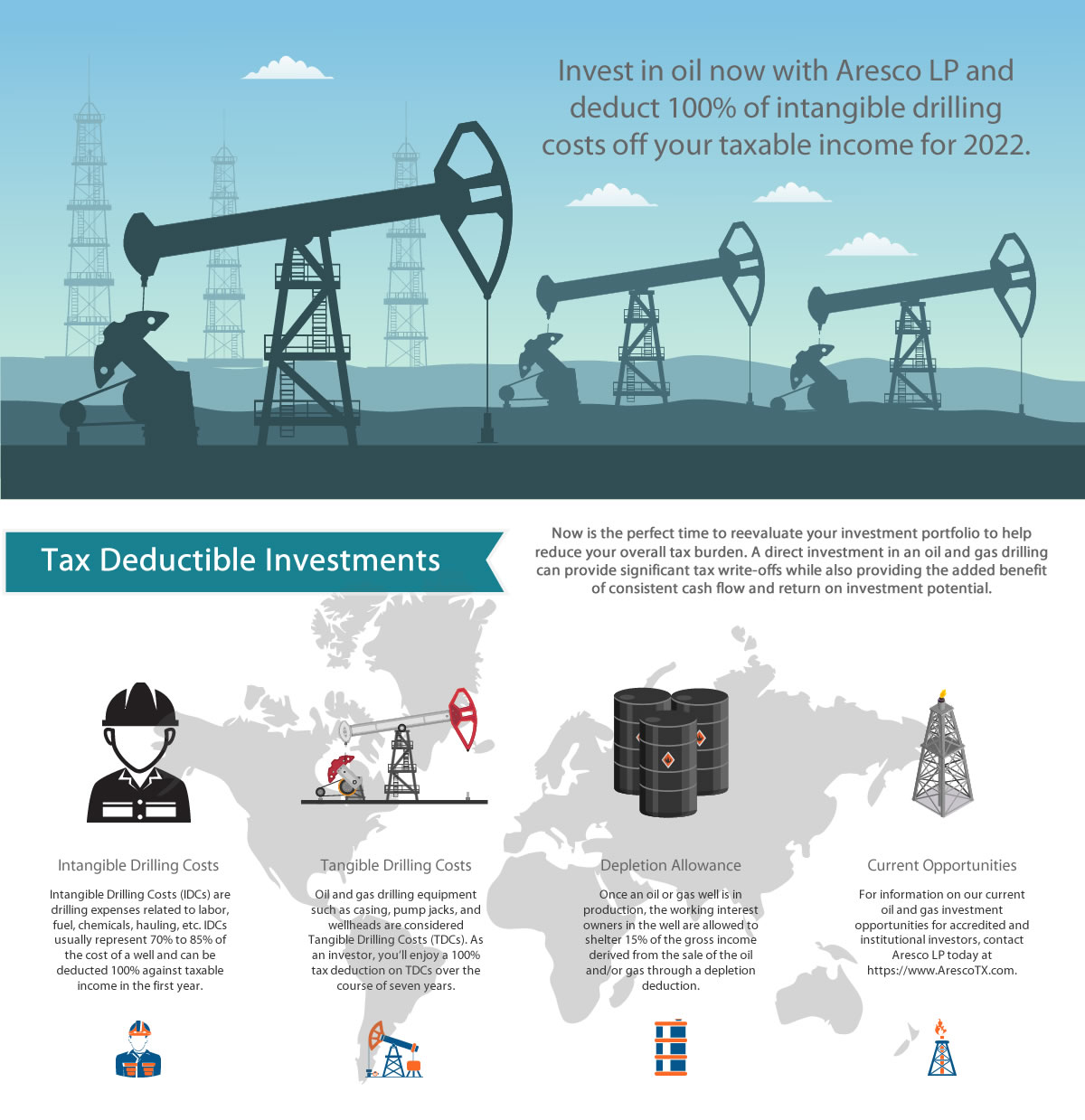

Invest in oil now with Aresco LP and deduct 100% of intangible drilling costs off your taxable income for 2023.

Now is the perfect time to reevaluate your investment portfolio to help reduce your overall tax burden. A direct investment in an oil and gas drilling can provide significant tax write-offs while also providing the added benefit of consistent cash flow and return on investment potential.

Intangible Drilling Costs (IDCs) are drilling expenses related to labor, fuel, chemicals, hauling, etc. IDCs usually represent 70% to 85% of the cost of a well and can be deducted 100% against taxable income in the first year.

Oil and gas drilling equipment such as casing, pump jacks, and wellheads are considered Tangible Drilling Costs (TDCs). As an investor, you’ll enjoy a 100% tax deduction on TDCs over the course of seven years.

Once an oil or gas well is in production, the working interest owners in the well are allowed to shelter 15% of the gross income derived from the sale of the oil and/or gas through a depletion deduction.

For information on our current oil and gas investment opportunities for accredited and institutional investors, contact Aresco LP today at (972) 992-3127.

© Copyright 2024 Aresco, LP. All rights reserved. | Privacy Policy | Site by A3K Marketing. Admin Log in