Use our tax deduction calculator to learn more about the tax benefits of direct oil and gas investments for the 2024 tax year.

Use our tax deduction calculator to learn more about the tax benefits of direct oil and gas investments for the 2024 tax year.

ADVANTAGE 1

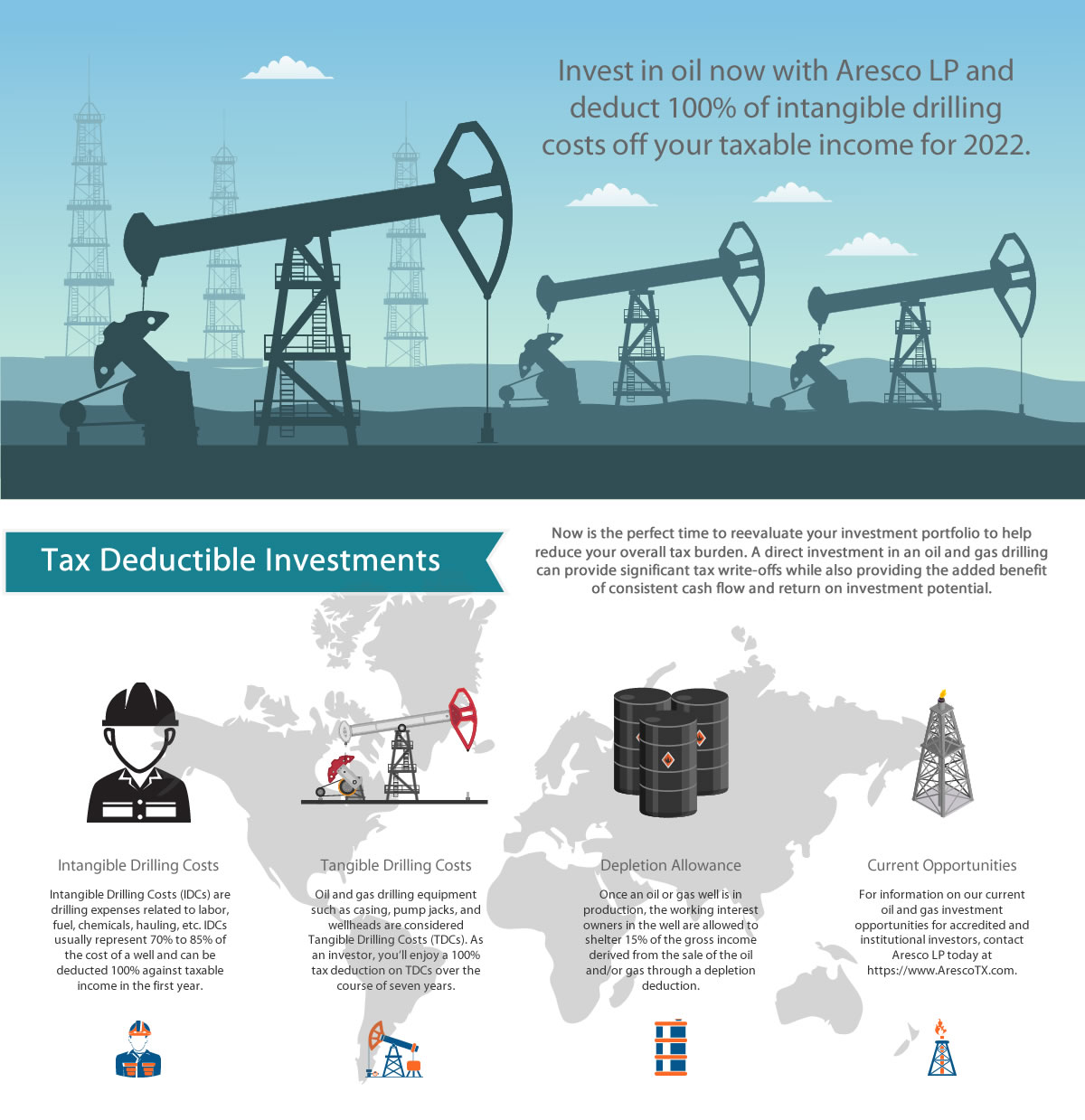

Intangible Drilling Costs (IDCs) typically represent approximately 70% to 85% of a well’s total cost and can be deducted 100% against taxable income in the first year of investment. IDC expenses include costs related to labor, chemicals, hauling, fuel, and the like.

IDCs can be deducted for the tax year in which the investment is made, even if the well does not start drilling until March 31st of the following year.

ADVANTAGE 2

Tangible Drilling Costs (TDCs) are equipment-related expenses that can be capitalized and depreciated over a 7-year period. TDCs include casing, pump jacks, and wellheads – basically, any expense associated with the equipment required to drill an oil or natural gas well including casing, pump jacks, and wellheads.

Intangible Completion Costs average approximately 15% of a well’s total cost. ICCs are goods and services like labor, completion materials, completion rig time, and fluids that have no salvage value. ICCs are 100% deductible for the tax year the expense was incurred.

ADVANTAGE 3

Once a well begins producing oil and/or natural gas, the working interest owners in the well can shelter a portion of the well’s annual production earnings from income tax through a depletion deduction. Two types of depletion are available, cost depletion and statutory (also referred to as percentage depletion). Regardless of type, a well’s depletion deduction will generally shelter 15% of the well’s annual production from income tax.

See how much a qualified, approved investor could potentially reduce their tax liability with a direct investment in oil and natural gas production with Aresco LP. Calculations are shown for illustrative purposes only. Please speak with your tax advisor for information specific to your situation.

To use our Tax Deduction Calculator, fill in your income, tax bracket, and the amount you’re looking to invest in an upcoming Aresco joint venture to calculate your potential first-year tax savings.

Now is the time to reevaluate your investment portfolio to potentially reduce your overall tax burden. Direct investment in oil and gas drilling can provide significant tax write-offs while also providing the added benefit of consistent cash flow and return on investment potential.

Do you quality as an accredited investor?

The above tax deduction calculator and general discussion is provided for background information only. This information is not intended to be individual advice. Prospective participants should consult with their personal tax professional regarding the applicability and effect of any and all benefits for their own personal tax situation. In addition, tax laws change from time to time, and there is no guarantee regarding the interpretation of any tax laws. For more information, please visit www.irs.gov.

© Copyright 2024 Aresco, LP. All rights reserved. | Privacy Policy | Site by A3K Marketing. Admin Log in