Our oil and gas investment analyst, advisory, and evaluation services are designed for individual, corporate, or institutional investors seeking assistance on the technical merits of an investment. Aresco conducts independent, unbiased evaluations of oil and gas opportunities. Our comprehensive, easy-to-understand analysis delivers a thorough assessment of the technical and commercial merits, identification of key risk factors, estimation of reserves and resources, and determination of the opportunity’s overall potential value.

For immediate assistance, please call (972) 992-3127 or click here to submit a request online.

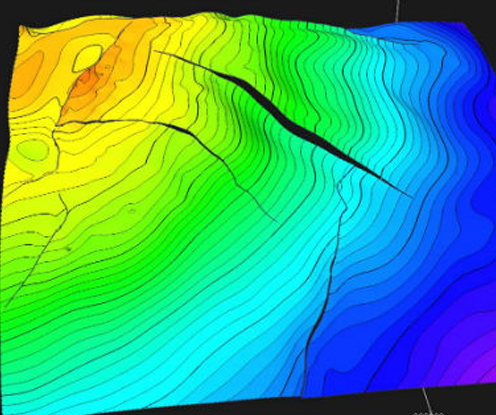

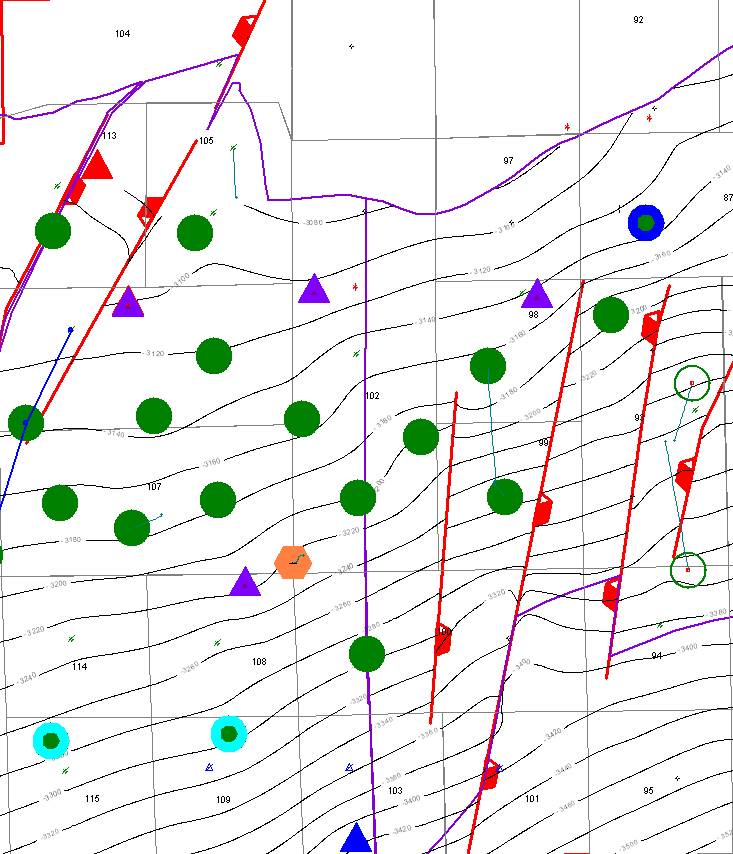

Any investment in oil and gas starts with the science involved in extracting hydrocarbons. Understanding the geology of a project creates a foundation for all further evaluation. Knowledge of the larger basin setting, regional changes, and project-specific geology determine whether hydrocarbons exist in a particular area and, more importantly, whether they can produced economically. To determine a project’s viability, Aresco’s methodology includes the examination of the quality of a particular reservoir’s rocks, trapping and sealing mechanisms, and the existence of a working hydrocarbon kitchen. Assuming a project passes the initial geologic requirements, Aresco’s reservoir engineering capabilities evaluate data related to fluid dynamics, production capabilities, and the long-term life of the prospect.

Geology & Engineering Services Include: Data Acquisition / Management, Well Log Interpretation, Petrophysics, Subsurface Mapping, Geomodeling, Core Analysis, Seismic Interpretation, Reserve Estimation, Production Forecasting, Decline Curve Analysis, Enhanced Oil Recovery, Field Development

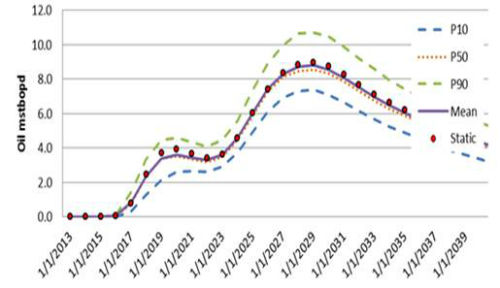

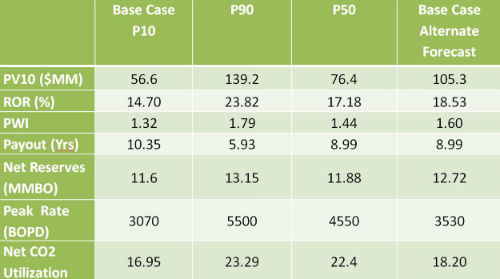

Following the establishment of a holistic geomodel and reservoir production capabilities, Aresco can provide further insight into the economics of an investment. A calculated production forecast, in concert with the capital needs to attain that production, come together to provide those economics. Aresco’s project-level economic evaluation includes analysis of net present value, rate of return, payback period, and cash flows.

There are risks involved in all investments. The key is understanding those risks and making decisions accordingly. Oil and gas investments in particular carry a complicated and variable set of factors that affect overall risk, factors that may create significant swings in a well’s production potential that ultimately affect overall investment performance.

To help mitigate investment risk, Aresco provides the following:

Rolling these tactics into a single workflow allows for an understanding of the risks of the particular investment so that you can make better educated decisions.

© Copyright 2024 Aresco, LP. All rights reserved. | Privacy Policy | Site by A3K Marketing. Admin Log in